Starting off with Shop Car Insurance Quotes: Avoiding Common Online Scams, this introductory paragraph aims to grab the readers' attention and provide a brief overview of the topic in a captivating manner.

The second paragraph delves into descriptive and informative details about the subject

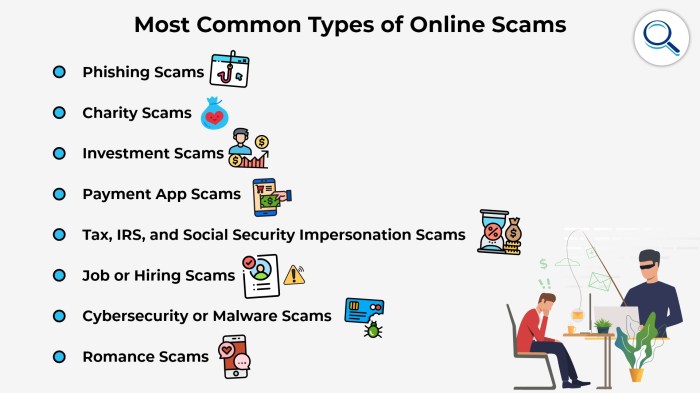

Understanding Common Online Scams Related to Car Insurance Quotes

When shopping for car insurance quotes online, it's crucial to be aware of the common scams that individuals may encounter. Scammers often target those looking for affordable insurance deals, taking advantage of their vulnerability and lack of knowledge in the industry.Key Red Flags to Watch Out For:

Unsolicited Emails or Calls

Be cautious of unsolicited emails or calls offering extremely low insurance rates. Legitimate insurance companies typically do not reach out to customers in this manner.

Pressure Tactics

Scammers may use high-pressure sales tactics to rush you into making a decision. Take your time to research and compare different insurance options before committing.

Lack of Information

If a website or provider is vague about their services, policies, or contact information, it could be a sign of a potential scam. Legitimate insurance companies are transparent about their offerings.How Scammers Manipulate Individuals:Scammers often lure individuals by offering unrealistically low insurance rates to attract attention.

Once they have the individual's interest, they may request personal information or payment details under the guise of processing the insurance policy. This information can then be used for identity theft or financial fraud, leaving the victim in a vulnerable position.It's essential to stay vigilant and verify the legitimacy of insurance providers before sharing any personal information or making payments online.

By recognizing these red flags and understanding how scammers operate, individuals can protect themselves from falling victim to online insurance scams.

Tips for Safely Shopping for Car Insurance Quotes Online

When shopping for car insurance quotes online, it's crucial to take steps to ensure the legitimacy of the websites you are using, research the insurance companies, and compare quotes securely. Here are some tips to help you navigate the process safely:

Verify the Legitimacy of Websites Offering Car Insurance Quotes

- Check for secure website connections (https://) to protect your personal information.

- Look for contact information, such as a phone number or physical address, to verify the credibility of the website.

- Avoid websites that ask for sensitive information upfront without providing clear details about the insurance policies.

Research the Insurance Company Before Providing Personal Information

- Check the insurance company's reputation through online reviews, ratings, and customer feedback.

- Verify the legitimacy of the insurance company by checking if it is licensed in your state.

- Avoid sharing personal information until you are confident about the credibility of the insurance provider.

Securely Compare Different Car Insurance Quotes Online

- Use reputable comparison websites that offer multiple quotes from various insurance companies.

- Ensure the comparison website has a privacy policy that protects your data from third-party access.

- Compare the coverage, deductibles, and premiums of different insurance quotes to make an informed decision.

Protecting Personal Information When Shopping for Car Insurance Quotes

In the digital age, safeguarding personal information is crucial when shopping for car insurance quotes online. Protecting sensitive data like Social Security numbers and driver's license information is essential to prevent identity theft and fraud.

Identifying Secure Websites for Submitting Personal Details

When comparing car insurance quotes online, it is important to verify that the website is secure before entering any personal information

- Look for "https://" at the beginning of the website URL, indicating a secure connection.

- Check for a padlock symbol in the address bar, which signifies encryption of data.

- Read the website's privacy policy to understand how your information will be protected.

Risks of Sharing Personal Information on Unsecured Platforms

Sharing personal information on unsecured platforms can expose you to various risks, including:

- Identity theft: Hackers can steal your sensitive information to commit fraud or other criminal activities.

- Financial loss: Unauthorized access to your personal data can lead to financial losses and unauthorized transactions.

- Phishing scams: Fraudsters may use your personal information to target you with phishing emails or fraudulent schemes.

Recognizing Trustworthy Sources for Car Insurance Quotes

When searching for car insurance quotes online, it is crucial to identify trustworthy sources to ensure the accuracy and reliability of the information provided. By distinguishing between legitimate websites and potentially fraudulent platforms, individuals can protect themselves from falling victim to scams.

Reliable Websites for Car Insurance Quotes

- Official websites of reputable insurance companies: Directly visiting the websites of well-known insurance providers such as Geico, Progressive, or State Farm can guarantee authentic quotes.

- Comparison websites: Platforms like NerdWallet, The Zebra, or Compare.com are known for providing unbiased comparisons from multiple insurance companies.

- State insurance department websites: Checking your state's official insurance department website can offer reliable information on licensed insurance providers in your area.

Contrasting Trustworthy Sources with Fraudulent Websites

- Trustworthy sources have secure websites: Legitimate insurance websites use encryption and secure protocols to protect users' personal information.

- Transparent pricing: Reliable sources provide clear and detailed information on coverage options, deductibles, and premiums without hidden fees or misleading details.

- Customer reviews and ratings: Genuine websites often feature customer feedback and ratings to showcase their reputation and credibility.

Differentiating Genuine Insurance Providers from Scam Sites

- Beware of unsolicited emails or pop-up ads: Scam sites often use aggressive marketing tactics to lure individuals into providing personal information.

- Verify contact information: Legitimate insurance providers have valid contact details, including a physical address and customer service hotline.

- Check for licensing and accreditation: Genuine insurance companies are licensed to operate in specific states and comply with industry regulations.

Closing Notes

Concluding with a summary and closing thoughts in an engaging style

Common Queries

What are some key red flags to watch out for when shopping for car insurance quotes online?

Common red flags include websites asking for sensitive personal information too early in the process, offers that seem too good to be true, and websites with poor user reviews. Always verify the legitimacy of the website before proceeding.

How can I protect my personal information when shopping for car insurance quotes online?

To protect personal data, ensure you are using secure websites (look for 'https' in the URL), avoid sharing sensitive information too soon, and research the insurance company's reputation. Be cautious of unsolicited emails or calls asking for personal details.

Where can I find trustworthy sources for car insurance quotes online?

Reliable sources for car insurance quotes include reputable insurance company websites, comparison sites with good reviews, and official insurance regulatory websites. Always cross-check information from multiple sources.