As Comparing Business Health Plans: Which One is Right for You? takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this comprehensive guide, we delve into the intricacies of choosing the right business health plan that suits your needs and the needs of your employees. From understanding the different types available to customizing plans, we explore all aspects to help you make an informed decision.

Introduction to Business Health Plans

Business health plans are essential packages offered by companies to provide medical coverage to their employees. These plans play a vital role in ensuring the well-being of staff members and can vary in coverage and cost. Choosing the right plan is crucial for both employers and employees as it impacts the overall health and satisfaction of the workforce.

Types of Business Health Plans

- Health Maintenance Organization (HMO): This plan requires employees to choose a primary care physician and obtain referrals to see specialists.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers, both in-network and out-of-network.

- High Deductible Health Plan (HDHP): HDHPs have lower premiums but higher deductibles, often paired with a Health Savings Account (HSA).

It is essential for employers to consider the needs of their employees when selecting a health plan to ensure adequate coverage and accessibility to healthcare services.

Importance of Choosing the Right Plan

- Employee Satisfaction: Offering a suitable health plan can enhance employee satisfaction and retention within the company.

- Cost Considerations: Selecting a plan that balances cost and coverage is crucial for both the employer's budget and the employees' out-of-pocket expenses.

- Health and Wellness Programs: Some health plans include wellness initiatives that can promote a healthier workforce and reduce overall healthcare costs.

Factors to Consider When Comparing Business Health Plans

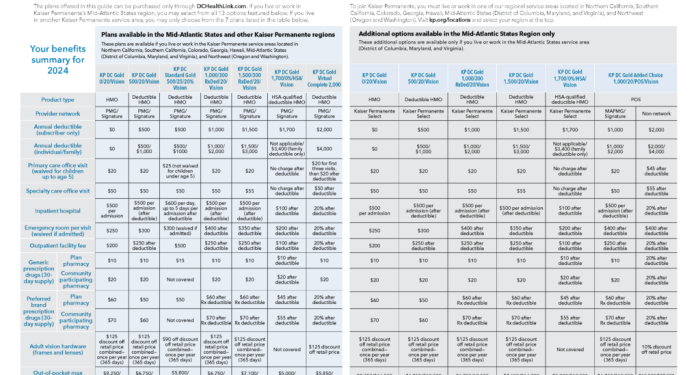

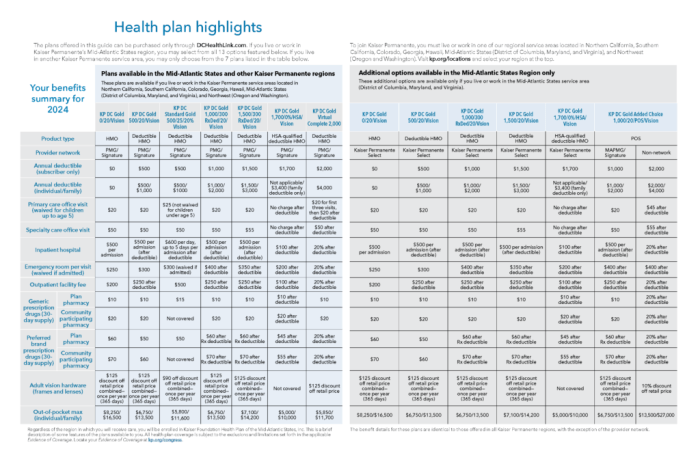

When comparing business health plans, several key factors should be taken into consideration to ensure that the chosen plan meets the needs of both the employees and the company as a whole. These factors include cost, coverage, network size, and flexibility.

Cost

Cost is a crucial factor when choosing a business health plan. Employers need to consider not only the monthly premiums but also the deductibles, copayments, and coinsurance. A plan with lower premiums may have higher out-of-pocket costs, so it's essential to evaluate the overall cost of the plan based on the specific needs of the employees and the budget of the company.

Coverage

Coverage refers to the services and treatments that are included in the health plan. Employers need to ensure that the plan provides adequate coverage for preventive care, prescription drugs, specialist visits, hospital stays, and other essential health services. It's important to review the list of covered services and assess whether they align with the healthcare needs of the employees.

Network Size

The network size of a health plan determines the number of healthcare providers and facilities that are included in the plan's network. Employers should evaluate whether the plan includes a wide network of doctors, hospitals, and specialists to provide employees with access to quality healthcare services.

A larger network size can offer more options for healthcare providers, while a smaller network may limit choices but could potentially lower costs.

Flexibility

Flexibility in a health plan allows employers and employees to make changes or adjustments to the coverage as needed. It's important to consider whether the plan offers options for adding dependents, changing coverage levels, or selecting different healthcare providers. A flexible plan can accommodate the diverse needs of employees and adapt to changes in the company's workforce.Employee Needs and Company SizeEmployee needs and the size of the company can significantly influence the choice of a health plan.

Employers should consider the demographics of their workforce, such as age, health conditions, and family status, to determine the level of coverage required. Additionally, the size of the company can impact the bargaining power and negotiating ability with insurance providers, leading to more competitive rates and customized plan options.

Types of Business Health Plans

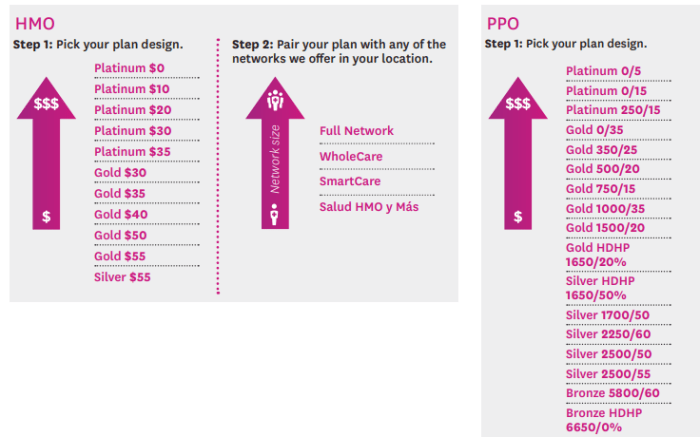

When it comes to choosing a health plan for your business, there are several options available. Understanding the differences between these plans can help you make an informed decision that meets the needs of both your company and your employees.

Traditional Health Insurance Plans vs. High-Deductible Health Plans (HDHPs)

Traditional health insurance plans typically have higher monthly premiums but lower out-of-pocket costs when employees need medical care. On the other hand, HDHPs have lower monthly premiums but higher deductibles, requiring employees to pay more out of pocket before insurance coverage kicks in

Employers may opt for HDHPs to save on premiums, while employees who are generally healthy may find them cost-effective. However, employees with chronic conditions or frequent medical needs may face financial challenges with HDHPs.

Preferred Provider Organizations (PPOs) vs. Health Maintenance Organizations (HMOs)

PPOs offer more flexibility in choosing healthcare providers and do not require referrals to see specialists. However, they tend to have higher premiums and out-of-pocket costs. On the other hand, HMOs typically have lower premiums and lower out-of-pocket costs but require employees to choose a primary care physician (PCP) and obtain referrals to see specialists.

HMOs may be more cost-effective for businesses looking to control healthcare expenses, especially if their employees are willing to adhere to network restrictions.

Benefits and Drawbacks of Each Type of Plan

- Traditional Health Insurance Plans:

- Benefits: Lower out-of-pocket costs, comprehensive coverage

- Drawbacks: Higher premiums, less flexibility

- High-Deductible Health Plans (HDHPs):

- Benefits: Lower premiums, potential for health savings accounts (HSAs)

- Drawbacks: Higher deductibles, increased out-of-pocket costs

- Preferred Provider Organizations (PPOs):

- Benefits: Provider choice, no referrals needed

- Drawbacks: Higher costs, less cost control

- Health Maintenance Organizations (HMOs):

- Benefits: Lower costs, coordinated care

- Drawbacks: Network restrictions, need for referrals

Customizing Business Health Plans

When it comes to business health plans, customization is key to meeting the unique needs of employees. By tailoring health plans, companies can ensure that their workforce receives the right coverage and benefits.

Role of Voluntary Benefits

Voluntary benefits play a crucial role in enhancing a health plan's coverage. These benefits allow employees to choose additional coverage options that meet their individual needs. From vision and dental coverage to life insurance and disability benefits, voluntary benefits provide employees with a comprehensive and personalized health plan.

Integrating Wellness Programs and Incentives

Wellness programs and incentives can be seamlessly integrated into business health plans to promote employee health and well-being. By offering incentives for healthy behaviors such as regular exercise, smoking cessation, or preventive screenings, companies can encourage employees to prioritize their health.

Wellness programs can include fitness challenges, nutrition counseling, mental health resources, and more to support employees in leading healthier lifestyles.

Conclusive Thoughts

In conclusion, the journey of comparing and selecting the ideal business health plan is one that requires careful consideration and evaluation. By weighing factors and understanding the nuances of each plan type, employers can ensure they provide the best health coverage for their employees.

FAQ Summary

What factors should I consider when comparing business health plans?

Factors to consider include cost, coverage, network size, and flexibility. Each of these can impact your decision-making process significantly.

What are the differences between Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs)?

PPOs offer more flexibility in choosing healthcare providers, while HMOs require referrals for specialists and have a primary care physician.

How can businesses customize health plans to meet employee needs?

Businesses can tailor health plans by adding voluntary benefits, incorporating wellness programs, and offering incentives to promote better health.