Delve into the world of homeowners insurance quotes to uncover the true essence of what you're paying for. Get ready for a detailed exploration that sheds light on the intricacies of this crucial aspect of home ownership.

Understanding Homeowners Insurance Quote

When you receive a homeowners insurance quote, it is important to understand what is included in the quote to ensure you are adequately protected. Here is a breakdown of what a homeowners insurance quote typically includes:

Common Components in a Homeowners Insurance Quote

- Premium: This is the amount you will pay for the insurance coverage. It can vary based on factors such as the value of your home, location, and coverage limits.

- Deductible: The deductible is the amount you will have to pay out of pocket before your insurance kicks in to cover a claim.

- Coverage Types: This Artikels the specific types of coverage included in the policy, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage.

- Policy Limits: These are the maximum amounts your insurance will pay out for covered losses. It is crucial to ensure these limits are sufficient to cover potential risks.

- Exclusions: This section lists what is not covered by the policy. It is essential to review these exclusions to understand potential gaps in coverage.

Importance of Reviewing and Understanding the Details

It is essential to carefully review and understand the details of a homeowners insurance quote to make sure you are adequately protected in case of unforeseen events. By understanding the components of the quote, you can customize your coverage to suit your needs and budget, ensuring you have the right level of protection for your home and belongings.

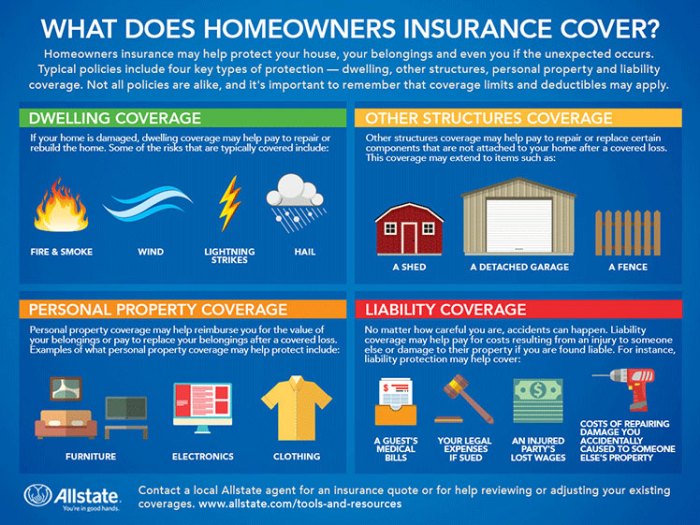

Coverage Types in Homeowners Insurance

When it comes to homeowners insurance, there are several types of coverage options available to protect your home, belongings, and finances in case of unexpected events. Understanding these coverage types is crucial to ensure you have the right level of protection for your specific needs.Dwelling Coverage:Dwelling coverage is the most basic and essential part of a homeowners insurance policy.

It protects the structure of your home, including walls, roof, floors, and built-in appliances, against damage caused by covered perils such as fire, windstorms, and vandalism. This coverage ensures that you can repair or rebuild your home in case of a covered loss.Personal Property Coverage:Personal property coverage protects your belongings inside your home, such as furniture, clothing, electronics, and other personal items, in the event of theft, damage, or destruction.

This coverage helps you replace or repair your possessions if they are damaged or stolen, providing you with financial assistance to recover from losses.Liability Protection:Liability protection is another important coverage type in homeowners insurance. This coverage offers financial protection if someone is injured on your property or if you accidentally damage someone else's property.

It helps cover legal fees, medical expenses, and settlement costs if you are found liable for the injury or damage, giving you peace of mind and protection against potential lawsuits.Additional Living Expenses Coverage:Additional living expenses coverage, also known as loss of use coverage, helps cover the cost of temporary living arrangements if your home becomes uninhabitable due to a covered loss.

This coverage includes expenses such as hotel stays, meals, and other accommodations while your home is being repaired or rebuilt, ensuring that you and your family have a place to stay during a challenging time.Medical Payments Coverage:Medical payments coverage provides coverage for medical expenses if someone is injured on your property, regardless of who is at fault.

This coverage helps pay for medical bills, ambulance fees, and other medical expenses for the injured party, without the need for a lawsuit. It offers a quick and easy way to handle minor injuries and prevent them from escalating into costly legal disputes.By understanding the different types of coverage offered in a homeowners insurance policy, you can make informed decisions about the level of protection you need to safeguard your home, belongings, and finances against unexpected events.

Factors Influencing Homeowners Insurance Quote

When determining the cost of homeowners insurance, several factors come into play. These factors can significantly impact the final insurance quote you receive. Understanding these key elements can help you make informed decisions when selecting your coverage.

Location

The location of your home plays a crucial role in determining your homeowners insurance premium. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance premiums due to the increased risk of damage.

Additionally, the crime rate in your neighborhood can also affect your insurance costs.

Home Value

The value of your home is another important factor that influences your insurance quote. The higher the value of your home, the more expensive it may be to insure

Deductible

The deductible you choose for your homeowners insurance policy can impact your premium. A higher deductible typically results in a lower premium, as you are agreeing to pay more out of pocket in the event of a claim. On the other hand, a lower deductible will lead to a higher premium since the insurance company will be responsible for a larger portion of the claim.

Coverage Limits

The coverage limits you select for your homeowners insurance policy will also affect the cost of your premium. Higher coverage limits provide more extensive protection but come with higher premiums. Conversely, lower coverage limits may be more affordable but could leave you underinsured in the event of a significant loss.

Additional Considerations in Homeowners Insurance Quotes

When obtaining a homeowners insurance quote, there are additional considerations to keep in mind beyond the basic coverage types and factors influencing the quote. Homeowners have the option to add optional coverages to their policy, include endorsements or riders for added protection, and even consider bundling home and auto insurance policies for potential cost savings.

Optional Coverages in Homeowners Insurance

Homeowners insurance policies typically come with standard coverages for things like dwelling, personal property, liability, and additional living expenses. However, there are optional coverages that homeowners can add to their policy for extra protection:

- Flood insurance: Protection against flood damage, which is typically not covered under a standard policy.

- Earthquake insurance: Coverage for damage caused by earthquakes, which is also not included in most standard policies.

- Sewer backup coverage: Protection against damage from sewer backups, which can cause costly repairs.

- Scheduled personal property coverage: Additional coverage for high-value items like jewelry, art, or collectibles.

Endorsements and Riders

Endorsements or riders are additional provisions that can be added to a homeowners insurance policy to enhance coverage for specific items or situations. These can include:

- Identity theft coverage: Protection against identity theft-related expenses and losses.

- Equipment breakdown coverage: Coverage for the repair or replacement of household systems and appliances.

- Inflation guard endorsement: Adjusts coverage limits annually to account for inflation and rising costs.

Bundling Home and Auto Insurance Policies

Many insurance companies offer discounts to policyholders who bundle their home and auto insurance with the same provider. By combining policies, homeowners can potentially save money on both premiums. This bundling can also result in added convenience of managing all insurance needs under one provider.

Final Summary

As we wrap up our discussion on homeowners insurance quotes, remember that knowledge is key when it comes to protecting your most valuable asset. Stay informed, stay covered, and stay secure.

Answers to Common Questions

What does a homeowners insurance quote typically include?

A homeowners insurance quote usually includes coverage for your dwelling, personal property, liability protection, and additional living expenses.

How do factors like location and home value influence homeowners insurance quotes?

The location of your home, its value, deductible amount, and coverage limits all play a significant role in determining the cost of your homeowners insurance quote.

What are some optional coverages that can be added to a homeowners insurance policy?

Optional coverages can include protection for valuable items, identity theft, and increased liability limits beyond the standard coverage.